Content publication date

From the moment Colombia began to gradually resume its economic and productive activities in April, under the protocols established by the Ministry of Health, the automotive and construction sectors have achieved significant results.

Construction sector

Housing development achieved great results in June, proving that it is a valuable instrument to boost investment and create jobs, and that the sector will play a key role in the country's economy in the upcoming months.

According to the Colombian Chamber of Construction, Camacol, 12,912 new housing units were sold in June, with a 55% increase as compared to the previous month. Social housing (VIS, as per its Spanish acronym) stood out with 8,860 units, while the other types of housing amounted to 4,052 units; both segments experienced a growth of more than 50% from the launch of new projects. In addition, the supply volume of new social housing in June was 7,029 units, a 42.2% increase.

Taking into account that the construction sector is vital for Colombia’s reactivation and that the industry has been recovering, Camacol has structured a proposal of 10 initiatives to boost the sector, increase investment, and reform the regulatory conditions to drive all housing segments and the construction of residential and non-residential housing. Some of the initiatives proposed include:

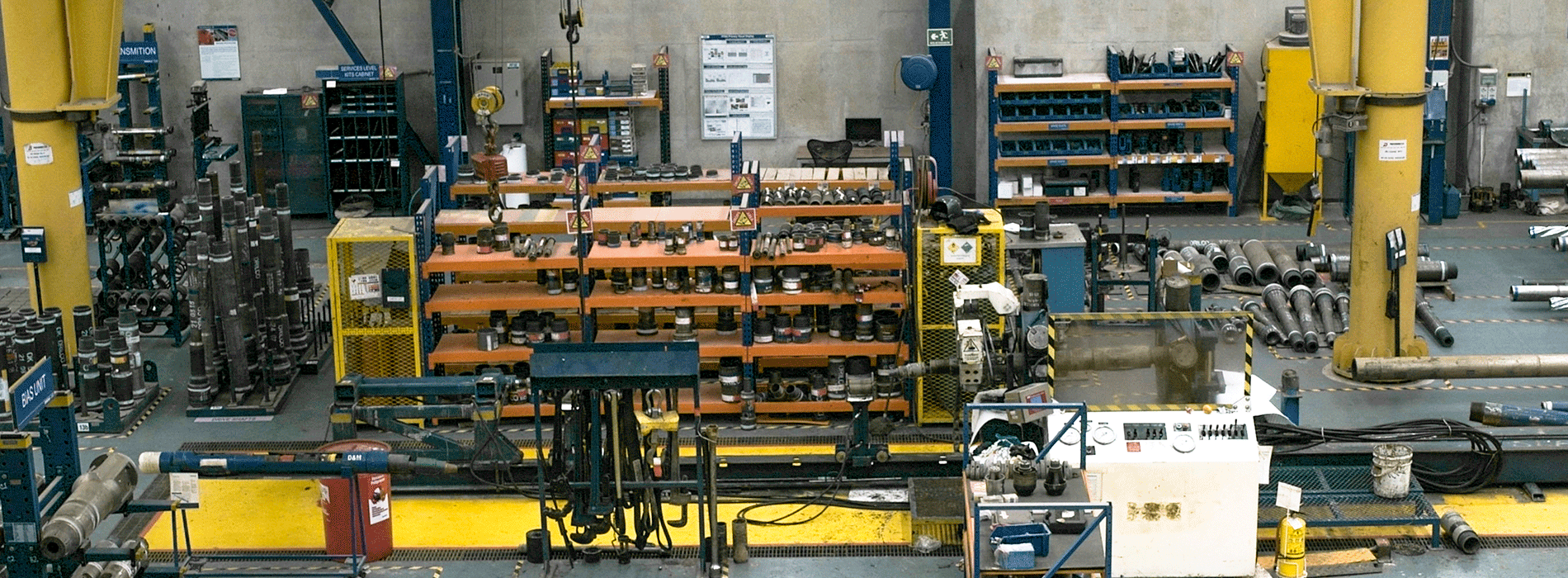

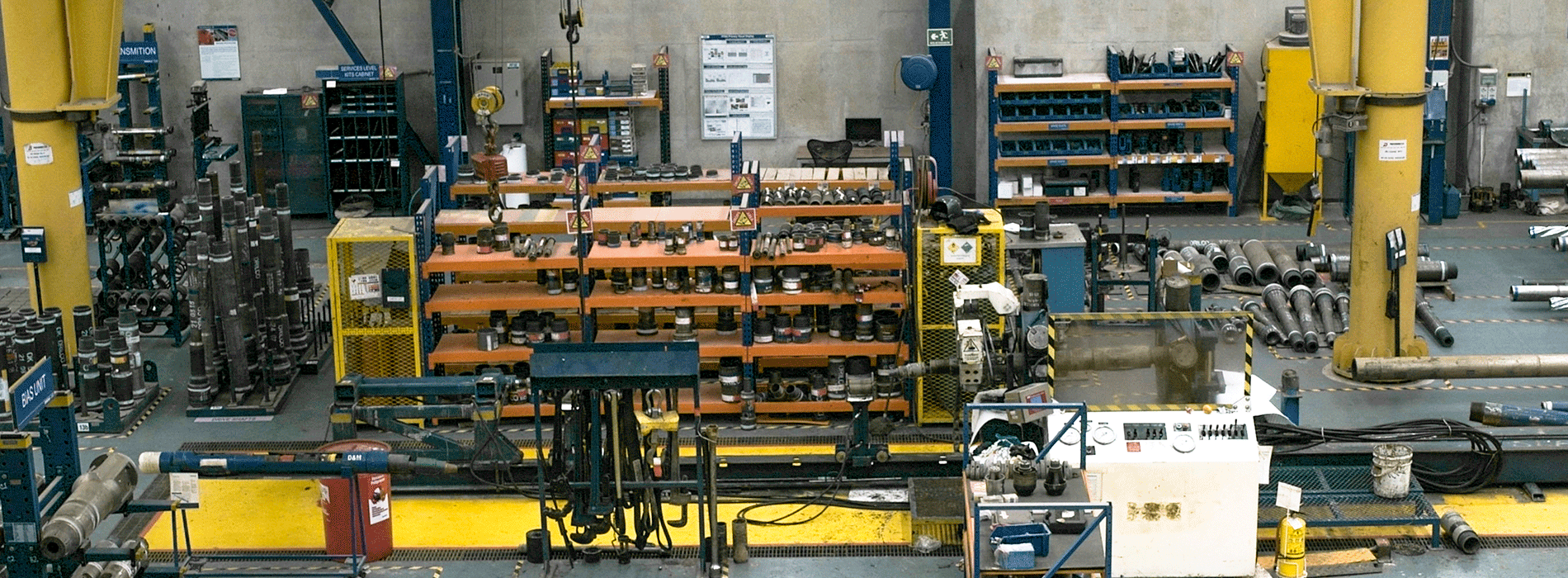

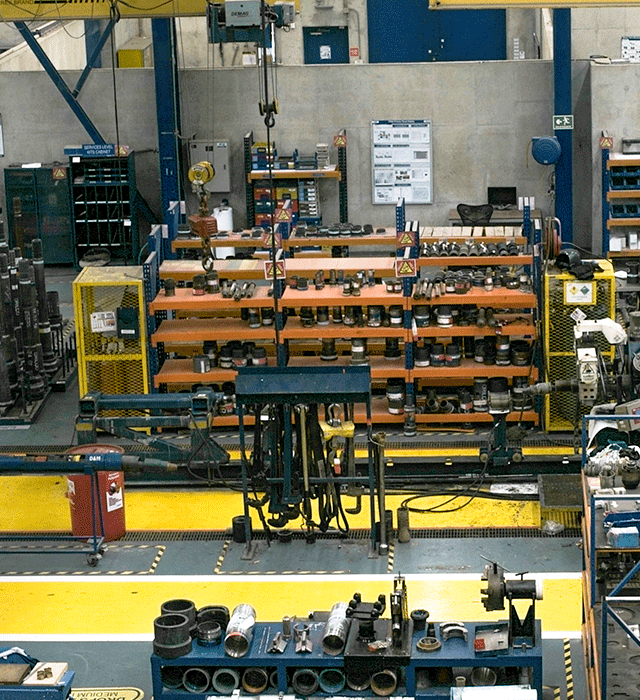

Automotive industry

The automotive market experienced significant results in June and has partially recovered since some activities have resumed. According to the National Association for Sustainable Mobility (ANDEMOS, as per its Spanish acronym), 11,981 vehicles were registered in June, which is 34% more than in May. Zero- and low-emission car sales are also encouraging, showing a 155% increase.

The automotive sector is relevant due to the linkages it generates with other sector industries such as metalworking and car parts, the revitalization of the vehicle market, repair and maintenance activities, and the sale of spare parts.

Additionally, the Ministry of Health issued Resolution 1054 concerning the aviation industry, specifying the measures to be adopted by domestic flights, and announced that some airports could begin a pilot plans for passenger air transport, with the prior authorization of the competent authorities and in full compliance with biosafety protocols. According to the Civil Aviation Authority (Aerocivil), El Dorado Airport in Bogotá is at 95% compliance with biosafety protocols, and the José María Córdova Airport in Rionegro is at 90% compliance.

Government initiatives to boost economic recovery

On July 22nd, the government announced the implementation of 13 economic reactivation actions that will impact foreign trade, foreign investment, business development, and tourism.

The strategies include business financing for SMEs and economic reactivation plans for micro-enterprises, as well as regional reactivation, with specific plans in all 32 departments.

In terms of foreign trade, the reactivation plan seeks to boost productivity, providing access to instruments such as the Vallejo Express Plan and the Special Import Regime (REI, as per its Spanish acronym), with lower import costs and greater promotion of knowledge-based service exports.

Other actions include seizing new business opportunities by increasing Colombia’s participation in global value chains and public procurement. We have identified 3,473 international buyers and 1,911 Colombian companies that can increase business with 134 products and services prioritized by export potential.

As for foreign investment efficiency, we have implemented sectoral and regional facilitation measures and strengthened the investors relocation strategy.